I’ve been eager to know about the investment process in film financing and how it compares to startup funding. I sat down with Editi Effiong, producer of the recently released "The Black Book," to delve into the world of film investments, due diligence, and valuation.

Discover why USSD usage is declining in Nigeria, reshaping the fintech landscape, as factors like reduced telecom investments and the rise of faster alternatives impact financial services.

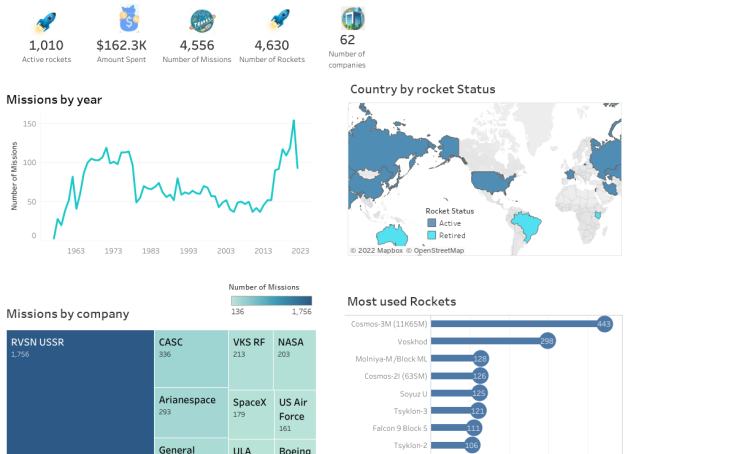

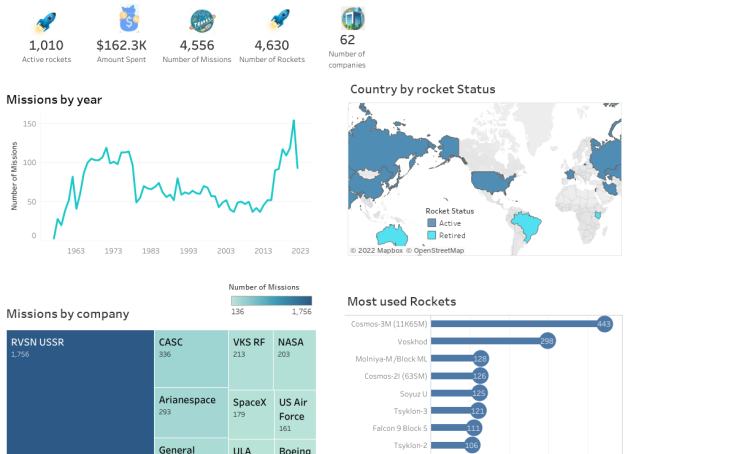

Data Analytics Portfolio

January, 2023

I did an analysis on a microfinance institution based in Nigeria. In this analysis, I presented the percentage breakdown of portfolio balance, PAR 15, percentage of portfolio balance that is in arrears and number of customers in the portfolio. Tool used: PowerBi

In this project, I prepared a financial module for an E-commerce company. The module showed the revenue plan, cost of sales, operating expenses and profit margin for the next four years. Tool used: Excel

In this project I analyzed and created a dataset for a telecom. The dashboard presents the reason for the high churnrate in the company. Tools used: PowerBI

Using PowerBI, I prepared a profit and loss statement for a company over a specific period.

Performed exploratory data analysis using python to explore Yahoo Finance Data. The data was imported from the web using Data reader and visualized with malplotlib and seaborn

In this case study, two $10,000 investment portfolios containing four stocks were built. The first portfolio has an equal weighting between the stocks. The second portfolio was optimized with a weighting allocation that provides the best return, adjusted for risk. Tools used: Numpy, Pandas, Matplotlib, Datareader